One-for-One

After the largest Quantitative Easing in the history of Monetary Policy to battle the Great Recession, the Federal Reserve is going to presently conduct the largest and first ever Quantitative Tightening of all time. This season is upon us. At the same time, another large monetary confluence is happening. Congress is passing a Tax Reform Bill. Within its provisions, because of the current legacy tax code, trillions of corporate dollars have been held off-shore in lower tax-rate havens. By allowing repatriation of these corporate retained earnings, trillions of dollars will flow back into the U.S. at lower tax rates. These inbound resources can either be eventually consumed, saved or taxed. Together with the easing of the past and the proposed repatriation, this has the potential of creating an enormous pool of gross capital, which could become a quantity of too much money chasing too few intermediate inputs. Current economic optimism also creates more transactions and greater velocity of money as well. According to the best theories, this blend of economic substance will create coincident inflation.

After the largest Quantitative Easing in the history of Monetary Policy to battle the Great Recession, the Federal Reserve is going to presently conduct the largest and first ever Quantitative Tightening of all time. This season is upon us. At the same time, another large monetary confluence is happening. Congress is passing a Tax Reform Bill. Within its provisions, because of the current legacy tax code, trillions of corporate dollars have been held off-shore in lower tax-rate havens. By allowing repatriation of these corporate retained earnings, trillions of dollars will flow back into the U.S. at lower tax rates. These inbound resources can either be eventually consumed, saved or taxed. Together with the easing of the past and the proposed repatriation, this has the potential of creating an enormous pool of gross capital, which could become a quantity of too much money chasing too few intermediate inputs. Current economic optimism also creates more transactions and greater velocity of money as well. According to the best theories, this blend of economic substance will create coincident inflation.

In a larger sense, given this enormous quantity of exogenous and endogenous money existing between on-shore and off-shore accounts, nobody really knows how much money is in the game now or just now. There is a way forward. The Federal Reserve has the ability to print and shred its Notes—physical and electronic. The Federal Reserve also has the luxury of having a set-of-books that can remain private, independent and un-audited. Corporations do not. In this delicate balance of the confluence of enormous forces, the Federal Reserve is poised to become the most important player and coach in public service history since its 1913 creation. Their most reserved, coveted and branded money can be confidentially substituted on and off the field, retired or created. With all that, there has never been so much at stake.

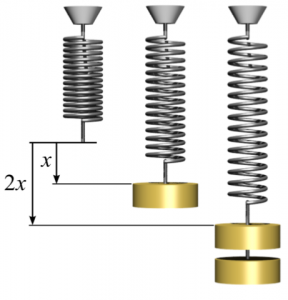

What could be done to win for everyone this national and international game? Something intuitive. It is the opinion of this author, that the Federal Reserve should monitor their monetary weirs as much as possible and adopt the following appurtenant Monetary Policy: One-for-One. It’s simple. To better manage the current delicate economic détente, for every corporate dollar that is repatriated back into the domestic system under the new Tax Act, one current dollar that was part of the quantitative easing program should be taken out of the domestic system. This is a matching principle. This proposed Policy is not a prediction but a prayer. Whatever it takes—the Fed’s balance sheet entries can be compressed or expanded, written up or written off—resulting in whatever they need to be. After all, acting in their self-interests, the Fed is now an indispensable quasi-non-profit answering mostly to themselves. We hope that their charity never faileth.

© 2017, J.W.Carlson